Stand out for the right reasons

How financial services lost its mojo – and how it can get it back

Trust Broken: Why the Collapse in Confidence in Financial Institutions Matters

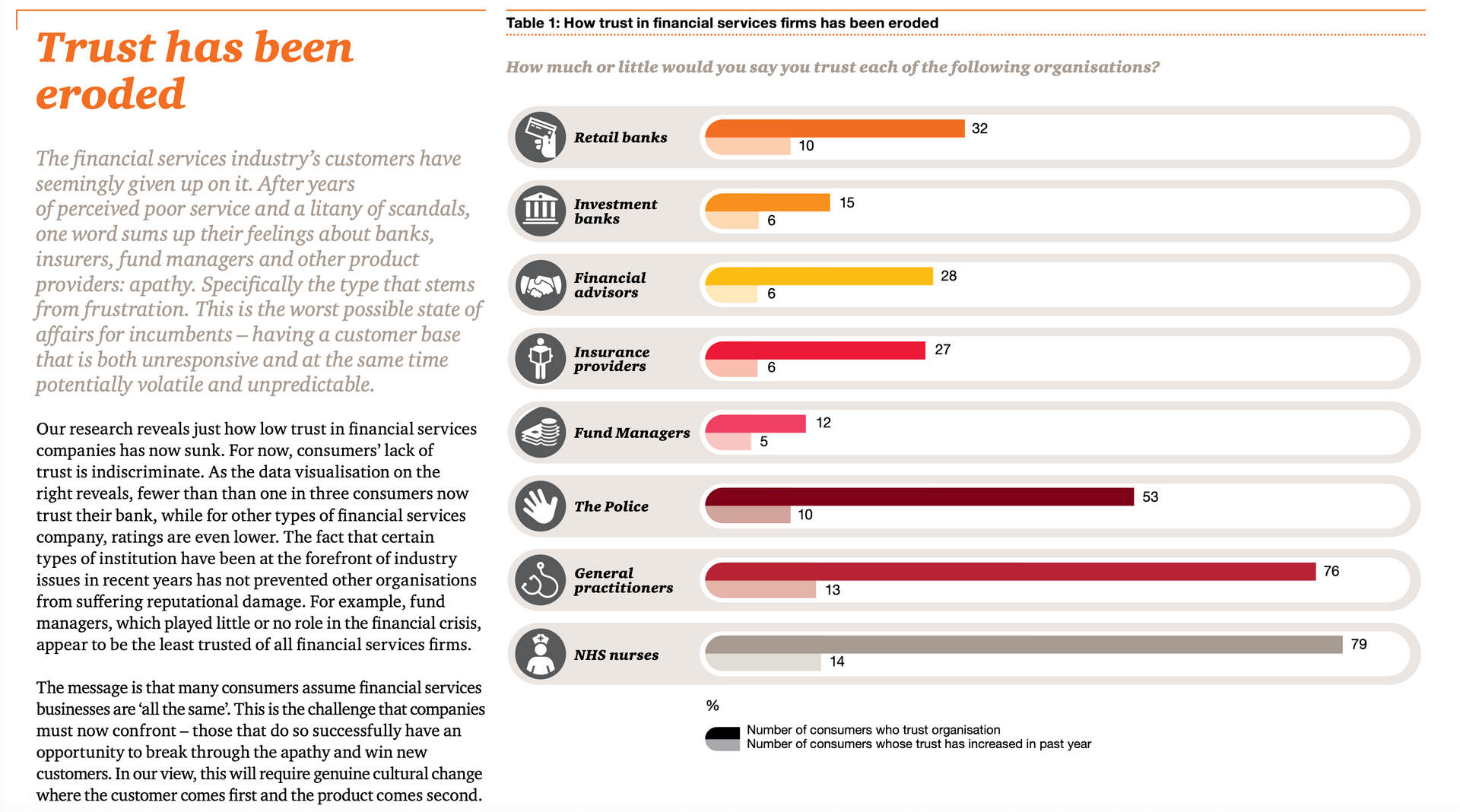

A fraud loss is more than just money disappearing—it’s the shattering of trust. When the institutions we depend on seem to let us down, it amplifies the pain. That’s exactly what a major PwC UK report from October 2014 reveals: How Financial Services Lost Its Mojo – and How It Can Get It Back. You can read the full report here: PwC Report – How Financial Services Lost Its Mojo (PDF).

Why Trust in Financial Institutions Collapsed

According to the PwC report, trust eroded for several reasons:

- Profit Over People

Many consumers believed financial firms prioritised profit, not the welfare or protection of their customers. For fraud victims, this feels like being treated as a number, not as a harmed individual. - Unfair Fees & Opaque Terms

Hidden charges, complexity, and vague contractual terms left people feeling misled—and distrust grows when victims believe they weren’t given clear, fair treatment. - Poor Complaint Handling

When people raise concerns—especially in big issues like fraud—the response is often slow, impersonal, or unsatisfying. Many reported feeling unheard or frustrated with outcomes. - Transparency Isn’t Enough Alone

Nearly half (46%) of those surveyed said that greater transparency about products and services would help restore trust. But many also felt that transparency alone wouldn’t go far unless institutions acted on what they revealed. - Security & Data Concerns

For many consumers—especially those who has suffered fraud—there was anxiety about how securely their financial data was handled, and whether institutions were sufficiently proactive in preventing breaches.

Why This 2014 Report Still Matters in 2025

Though the PwC report was published over a decade ago, its findings are more relevant than ever. Recent data shows that:

- Fraud is increasing: In 2024, the UK saw a record number of fraud cases (3.31 million) according to UK Finance, up by 12% from the previous year. Reuters

- Losses remain very high: The total lost to fraud was reported at £1.17 billion in 2024. Credit Connect

- Erosion of trust continues: For example, a 2024 survey by CRIF found that only 53% of UK consumers trust their bank or financial provider to look after their data safely — a lower percentage than across many parts of Europe and far behind in the U.S. CRIF

- Underreporting and emotional harm: A study by Wise in early 2025 revealed that two in three UK adults have been targeted by a scam, but many victims do not report it. Shame, embarrassment, and scepticism about whether anything can be done are major barriers. Wise Newsroom

This more recent data shows that many of the complaints PwC identified in 2014—around lack of transparency, inadequate care for customers, data security concerns, and ineffective complaint resolution—haven’t been fully resolved. In fact, in some cases, they have worsened or adapted to new technologies and fraud tactics.

What This Means for Fraud Victims

When trust is low and service is impersonal, victims of fraud are often retraumatised—not just by the scam itself, but by the way their case is handled afterwards.

Victims have report to us that they routinely experience:

- Slow or unclear responses

- A lack of accountability

- Minimal or delayed compensation

- An absence of empathy or support

- Confusion around their rights and next steps

In this environment, regaining confidence feels almost impossible. But it is possible—with the right knowledge, support, and action.

Rebuilding Trust: What Victims Can Do

Here are things you can demand or check so that your experience improves, and you regain some control.

Step

Insist on transparency

Get clear complaint and escalation info

Document everything

Demand better protection

Seek support

What to Ask / Do

Ask for a full written summary: how the fraud occurred, what steps are being taken, timelines, and what your rights are.

Find out: Who handles fraud cases? What is the process? How long should each stage take? To whom can you escalate if unsatisfied (ombudsman, regulator etc.)?

Keep copies of letters/emails, names, dates, reference numbers.

Ask about measures such as fraud alerts, account monitoring, two‐factor authentication, data protection standards.

Look for independent advice (e.g. consumer rights organisations), legal help, or victims’ groups.

Why It Matters

Knowing what’s happening reduces uncertainty and makes institutions accountable.

Helps avoid getting stuck in opaque or unresponsive loops.

Essential evidence if you need to escalate or seek compensation.

Prevents further damage and boosts your sense of security.

Helps in understanding your rights and navigating what can be a complex process.

What Financial Institutions Must Improve

From both PwC’s older report and more current data, there are clear ways financial services should reform:

- Put customer outcomes (not profits) at the centre of decision‑making and staff incentives.

- Ensure complaint handling is responsive, timely, empathetic, and doesn’t leave victims feeling ignored.

- Make transparency meaningful: clear, honest communication, not legal jargon or hidden clauses.

- Secure data robustly and show customers that they are taking action—not just words.

- Proactively adopt protections and tools to help victims get reimbursement and support

A Checklist for Fraud Victims: Is Your Financial Institution Earning Your Trust?

- Did they respond promptly and clearly when you reported the fraud?

- Have they explained what went wrong and how they’ll prevent it happening again?

- Were you treated with empathy and care?

- Have they provided ongoing support and tools to secure your accounts?

- Have they been transparent about processes, timelines, and your rights?

- Are there clear escalation routes if you're unhappy with their response?

If the answer is "no" to several of these, it’s not your fault. But it may be time to escalate your case or reach out to your MP.

Final Thoughts: You’re Not Just a Customer—You’re a Person

Trust is the foundation of any financial relationship. When it’s broken, the damage can be lasting—but not irreversible.

The PwC report makes it clear: consumers are demanding more transparency, better communication, stronger security, and, above all, humanity.

If you’ve been affected by fraud, you deserve more than a refund. You deserve reassurance, accountability, and care. That’s not just good service—it’s the bare minimum.

Let’s keep pushing for a system that puts people first.